Buying your first property in West London is exciting - but it's also the biggest financial commitment you'll ever make. At West London Surveyors, we work with first-time buyers daily, helping them navigate the surveying process and avoid costly mistakes. This comprehensive guide covers everything you need to know about property surveys as a first-time buyer.

Whether you're looking at a Victorian terrace in Chiswick, a modern apartment in Hammersmith, or a period conversion in Ealing, understanding building surveys will protect your investment and give you negotiating power.

Why You Absolutely Need a Property Survey

Many first-time buyers question whether they really need a survey, especially when budgets are tight. The answer is unequivocal: yes, you absolutely need one. Here's why:

Average unexpected repair costs found in unsurveyed properties (UK-wide data)

Properties have at least one significant defect requiring immediate attention

Average survey cost - insignificant compared to potential issues

Real Example: Ealing First-Time Buyer

A couple buying their first flat in Ealing skipped the survey to save £500. Three months after moving in, they discovered serious electrical issues and damp behind kitchen units. Total repair cost: £8,200. Their mortgage lender wouldn't have approved the property had they known, and they could have withdrawn or renegotiated.

What a Survey Protects You From:

- Structural problems - Subsidence, foundation issues, wall cracks

- Hidden damp - Behind walls, under floors, in roofs

- Roof defects - Expensive issues often invisible from ground level

- Electrical hazards - Dangerous wiring, inadequate earthing

- Plumbing problems - Lead pipes, poor drainage, leaks

- Timber issues - Rot, woodworm, structural weakening

- Boundary disputes - Unclear property lines, shared access issues

- Illegal alterations - Work done without building regulations approval

Understanding Survey Types: Which One Do You Need?

There are three main types of residential surveys in the UK, but as a first-time buyer, you'll be choosing between two:

| Survey Type | Best For | Cost | Detail Level |

|---|---|---|---|

| Level 1 (Condition Report) | New builds, modern apartments in excellent condition | £300-£500 | Basic overview only |

| Level 2 (HomeBuyer Report) | Standard properties built after 1900, good condition | £400-£700 | Good for most first-time buyers |

| Level 3 (Building Survey) | Properties pre-1900, poor condition, planned renovations | £600-£1,200 | Most comprehensive |

Our Recommendation for First-Time Buyers in West London:

Choose Level 2 If:

- Buying a Victorian/Edwardian property in good condition

- Property is a standard terraced house or purpose-built flat

- No obvious visible defects during viewings

- Property has been recently renovated

- You want clear, actionable guidance without overwhelming detail

- Budget is tight (Level 2 offers excellent value)

Upgrade to Level 3 If:

- Property is pre-1900 or looks run-down

- You noticed concerning signs (cracks, damp smell, sagging)

- Planning immediate renovations or extensions

- Property is unusual (listed building, thatched roof, etc.)

- Buying a fixer-upper as an investment

- You want maximum detail to plan future work

First-Time Buyer Tip

For most West London first-time buyers purchasing a standard Victorian terrace in reasonable condition, Level 2 is the sweet spot. It provides all the information you need to make an informed decision without paying for excessive detail you won't use.

The Survey Process: What to Expect

Understanding the survey process helps you time everything correctly and avoid purchase delays:

Book Your Survey (Day 1-2)

Contact surveying firms as soon as your offer is accepted. Get quotes from 2-3 RICS registered surveyors. West London Surveyors typically responds within 2 hours and can arrange surveys within 3-5 days.

Arrange Property Access (Day 3-7)

Your surveyor needs keys or access permission from the seller. Surveys take 2-4 hours depending on property size. You don't need to be present, but you're welcome to attend.

Survey Inspection Conducted (Day 7-10)

The surveyor examines all accessible areas: roof (from ground/ladder), exterior walls, interior rooms, loft space, floors and subfloors, services (electrics, plumbing, heating), drainage points, outbuildings.

Report Preparation (Day 10-15)

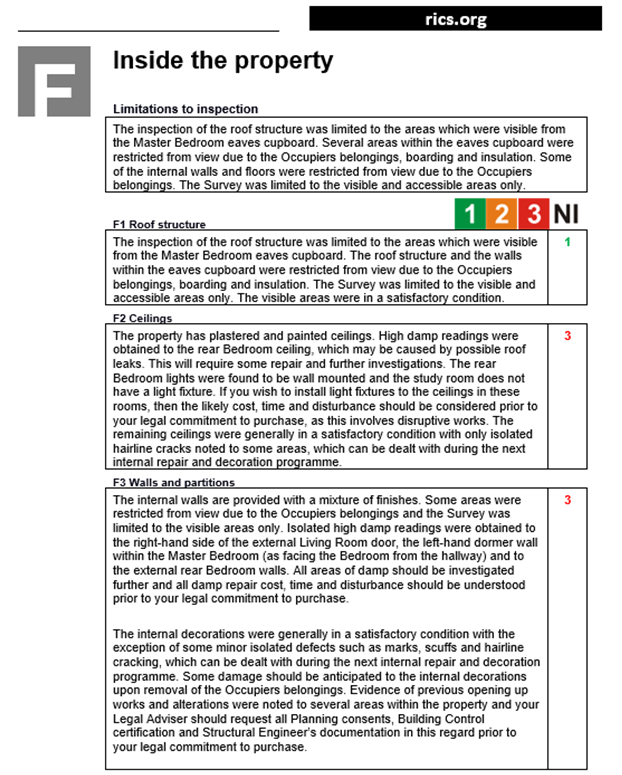

Surveyors compile findings into a detailed report. Level 2 reports are typically 20-30 pages. Includes traffic light ratings (green/amber/red), photos of key issues, recommendations for action.

Receive Your Report (Day 15)

Most surveyors send reports via email as PDF. Read it thoroughly before your solicitor needs to proceed. Don't panic at every amber/red rating - we'll explain how to interpret findings below.

Surveyor Consultation (Day 15-17)

CRUCIAL STEP: Call your surveyor to discuss the report. Ask questions, clarify concerns, get repair cost estimates. This call is included in your survey fee - use it!

Make Your Decision (Day 17-21)

Based on survey findings, you can: proceed as planned, renegotiate the price, request repairs before completion, request additional specialist surveys, withdraw from the purchase.

Reading Your Survey Report: Decoding the Traffic Light System

Level 2 reports use a traffic light system to rate defects. Here's what each rating really means:

| Rating | What It Means | Action Required |

|---|---|---|

| 🟢 Green (Condition 1) | No repair currently needed. Normal maintenance only. | None - proceed with confidence |

| 🟠 Amber (Condition 2) | Defects requiring repair or replacement, but not urgent. Budget for near-future work. | Get quotes, factor into budget, monitor condition |

| 🔴 Red (Condition 3) | Serious defects requiring urgent attention. May affect property value or safety. | Get specialist reports, renegotiate price, consider withdrawal |

Understanding Amber Ratings

Don't panic about amber ratings! Almost every property has some amber issues - they're normal wear and tear. In Victorian West London properties, expect amber ratings for: worn roof coverings (plan for replacement in 5-10 years), pointing requiring renewal (common, £2,000-£4,000), old windows needing draught-proofing (£500-£1,500), dated electrics (budget £6,000-£8,000 for rewire). These are manageable and expected.

Red Flags That Should Concern You:

- Structural movement requiring urgent attention

- Active damp or rot affecting structural timbers

- Dangerous electrical installation

- Failing drainage systems

- Major roof failure with active leaks

- Unsafe gas installations

- Building work done without proper approvals

Red issues require immediate action - don't ignore them hoping they'll go away!

Common Survey Findings in West London Properties

Based on hundreds of surveys we've conducted across West London, here are the most common issues by property type:

Victorian/Edwardian Terraced Houses (1850-1910)

- Original slate roofs nearing end of life (amber) - £15,000-£25,000 replacement

- Rising damp from lack of DPC (amber/red) - £3,000-£8,000 for injection DPC

- Bay window movement (amber) - £2,000-£5,000 for repairs

- Original single-glazed sash windows (amber) - £800-£1,500 per window

- Outdated electrical wiring (amber) - £6,000-£10,000 full rewire

- Solid wall construction (no cavity) - thermal efficiency concerns

1930s Semi-Detached Properties

- Cavity wall tie corrosion (amber) - £2,000-£4,000 replacement

- Original metal-framed windows (amber) - £8,000-£15,000 replacement

- Asbestos in roof/ceiling materials (note only) - specialist survey needed

- Concrete tile roofs at end of life (amber) - £12,000-£18,000

Modern Apartments (1990s-Present)

- Cladding concerns (request building safety certificate)

- Leasehold issues (not survey issues but crucial to check)

- Shared building system failures (check service charge history)

- Generally fewer structural issues but check building management

Using Survey Findings to Negotiate

One of the most valuable aspects of a survey is the negotiating power it gives you. Here's how to use it effectively:

When to Renegotiate the Price:

Calculate Repair Costs

Get quotes from contractors for red and high-amber issues. Be realistic - use these as negotiating evidence.

Present Evidence to Your Estate Agent

Send them key excerpts from the survey report and your contractor quotes. Be professional, not emotional.

Make a Reasonable Request

Don't expect to reclaim every penny of repair costs. A 50-70% reduction is more realistic and shows good faith.

Negotiation Example: Fulham Terrace

Purchase price: £725,000

Survey findings: Roof requires replacement (£18,000), rising damp treatment needed (£4,500), rewiring required (£7,500)

Total repair costs: £30,000

Buyer's request: £20,000 price reduction

Seller's counter: £15,000 reduction

Final agreement: £17,500 reduction

Result: Buyer proceeds at £707,500 with extra £12,500 in pocket for repairs beyond the discount.

When to Walk Away:

Sometimes the survey reveals problems so serious that proceeding isn't worth the risk:

- Severe structural issues with repair costs exceeding 15% of purchase price

- Evidence of illegal building work that affects structural integrity

- Multiple serious defects indicating poor maintenance throughout

- Seller unwilling to negotiate despite significant problems

- Problems that make mortgage unlikely (lenders won't fund seriously defective properties)

Budget Planning: The Real Costs

First-time buyers often focus only on deposit and mortgage, but there are many other costs:

| Cost Item | Typical Range | When Payable |

|---|---|---|

| Property Survey | £400-£1,000 | Before exchange |

| Solicitor Fees | £1,200-£2,000 | On completion |

| Stamp Duty (first-time buyer relief available) | £0-£15,000+ | Within 14 days of completion |

| Mortgage Valuation | £300-£600 | During mortgage application |

| Removal Costs | £400-£1,200 | On moving day |

| Immediate Repairs (from survey) | £2,000-£10,000+ | First 3-6 months |

Budget Wisely

As a rough guide, budget 3-5% of the purchase price for buying costs (surveys, legal fees, etc.) plus another 5-10% for immediate repairs and improvements identified in the survey.

Common First-Time Buyer Mistakes to Avoid

- Skipping the survey to save money - False economy that often costs far more later

- Choosing the cheapest surveyor - Quality matters; RICS registered surveyors are worth the investment

- Not reading the full report - Don't just scan the summary; read every section

- Ignoring amber ratings - These cost money too; budget for them

- Failing to call the surveyor - The consultation is included; use it!

- Not getting quotes for repairs - Know the real costs before committing

- Being too emotional - Stay objective; this is a huge financial decision

- Rushing the process - Take time to understand the survey and implications

Questions to Ask Your Surveyor

When you speak to your surveyor after receiving the report, ask:

- "Which issues are most urgent and why?"

- "What's the realistic cost range for the main repairs?"

- "Are any problems likely to get worse quickly?"

- "Do you recommend any additional specialist surveys?"

- "Is this property a good buy at the agreed price?"

- "What would you prioritize if I have a limited budget?"

- "Are there any issues that might affect mortgage approval?"

- "What maintenance should I plan for in the next 5 years?"

Why Choose West London Surveyors for Your First Survey

As first-time buyers, you need surveyors who understand your concerns and explain things clearly without jargon:

What Makes Us Different:

- First-time buyer specialists - We explain everything in plain English

- Comprehensive reports - Clear traffic light ratings with photos

- Always available to talk - Unlimited phone consultations included

- Fast turnaround - Reports within 5 working days

- Local expertise - We know West London properties intimately

- Fair pricing - Transparent quotes with no hidden fees

- RICS qualified - Professional indemnity insurance and regulation

Key Takeaways for First-Time Buyers

- NEVER skip the survey - it's your most important protection

- Level 2 HomeBuyer Survey is perfect for most West London first-time buyers

- Budget £400-£700 for the survey plus 5-10% of purchase price for repairs

- Amber ratings are normal and manageable; red ratings require action

- Always call your surveyor to discuss the report - it's included!

- Use survey findings to negotiate price reductions (be realistic)

- Book your survey immediately after offer acceptance

- Choose RICS registered surveyors with local West London experience

Ready to Book Your First Property Survey?

Congratulations on taking this huge step toward homeownership! A professional survey gives you the confidence and information needed to proceed safely with your purchase.

West London Surveyors has helped hundreds of first-time buyers across Hammersmith, Fulham, Chiswick, Ealing, and Richmond. We understand the process can feel overwhelming, which is why we're committed to clear communication and expert guidance every step of the way.

Contact us today for a free, no-obligation quote. We'll discuss your specific property, recommend the right survey level, and answer all your questions.